The next big thing in Open Banking

Key trends shaping the future of Open Banking, and the role of technology

When we hear the words Open Banking, we, especially as consumers of banking, equate it to Open Data - consumer data ownership. But open banking as it is today, is very little of this, and a lot more of connected ecosystems in banking.

Open banking is the main unlock to customer experience, growth and maturity of the connected banking ecosystem.

Who are the participants of the banking ecosystem? Why do they need APIs?

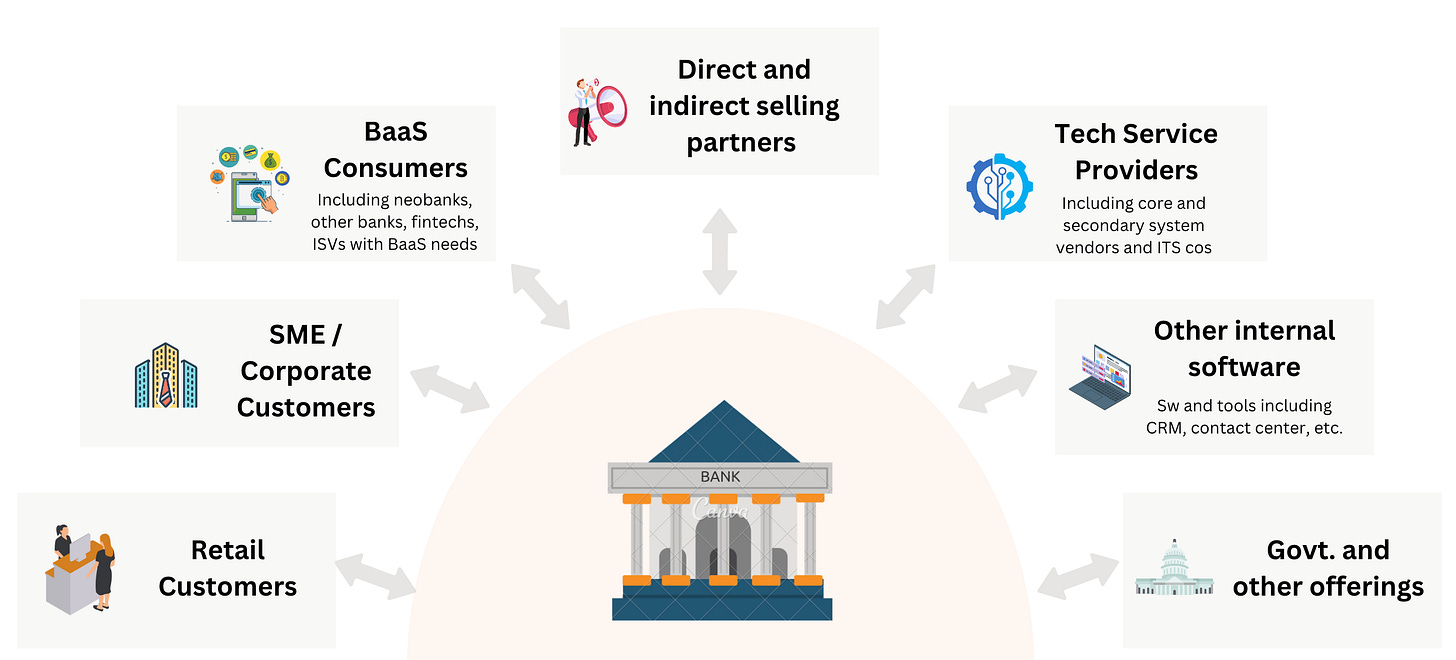

A typical financial bank interacts with a large number of entities - whether it is to sell products, offer services, complete backend operations, or even consume services.

This is a simplified illustration to show the key archetypes of entities that a bank needs to work with, specifically using technology.

Retail customers: these are individuals like you and me, who hold relationships with bank in the manner of deposit accounts, credit cards, or loans. For retail customers, banks typically offer the channels of netbanking, phone banking, and mobile app-based banking.

The average retail banking customer is not a developer, and there is very limited need to build headless APIs for this group.

There is the (small) emergent need for hyper-personalization in banking which can be API-led - think goal-based personal finance management, wealth management, investments and “savings pots”, bespoke product offers or experience - and there are examples of banks experimenting with APIs to allow their customers to develop their own “features” - see Monzo-IFTTT. However, this is fairly nascent, and not yet a focus area for most banks.

SME / Corporate customers: these customers interact a lot more with their banks, for a variety of products and services spanning accounts and cash management, F&A, payments and financing. For businesses that are significantly digitized, API-led direct access banking becomes one of the most important factors to decide which bank to work with.

And equally for banks, offering direct access via open banking APIs becomes a competitive moat - customers who have integrated with the bank’s APIs become “stickier” to the bank - transacting more, churning over less - especially given the on-boarding efforts and costs.

Examples of API products offered to corporate customers include -

Payments: bulk payments, including employee salary payments and vendor invoice payments

Virtual accounts and collections: automated collection and reconciliation

Financing: digital journeys for trade financing, receivables and invoice financing, dealer financing, business loans, etc.

An important consideration for corporate direct APIs offered by banks is the on-boarding experience. Banks not only need to provide detailed documentation, but also a concierge service to help on-board the customers, and train their relevant departments to use the API-led offerings.

In India, API-led direct access offerings for commercial customers are becoming table-stakes - necessary value-added services to complement the banking products and services. This is making it increasingly difficult for banks to directly monetize them - i.e. unlike typical API products, there is no precedence for pricing API usage on a volume or value metric. While there may be no direct revenue generated by these APIs, the value of these offerings is in the greater lifetime value and satisfaction of the commercial customer.

BAAS consumers: this archetype refers to companies who have their own customers, and who want to embed banking services in their own offerings, to complete the digital journeys for their customers. This includes -

Neobanks / digital banks - tech-first financial services players who have their own customers and origination channels, but work with traditional financial institutions to fulfil the offerings

Fintechs - similar to digital banks, specialized fintechs may want to offer specific banking services to their own customers (BNPL, financing and individual / P2P loans, special purpose credit cards, expense management, taxation and accounting, gift cards and pre-paid instruments, etc.) and may need to partner with banks for fulfilment

Other tech (non-fintech) offerings with BaaS needs - this bucket includes a variety of software or app-based offerings that need banking services for their customers. To illustrate this archetype with some examples:

Retail fintech - personal finance management, expense tracking, trading and investments, personal tax software all need access to the users’ bank accounts for account balance, historical transactions and funds transfer

Verticalized ISVs - software for educational institutions requires a virtual account solution for student fee collection; B2B marketplaces venturing into financing need current account opening solutions for their vendors; most consumer tech marketplaces in India who don’t have the payments aggregator licenses need to work with banks for a payments and virtual accounts solution

Horizontal ISVs - Payments players that need to allow penny-drop, account balance and money transfer; business accounting software need access to account balance and historical transactions

Such BaaS partnerships are win-win for both, the bank and the partner. While the partner is able to design an end-to-end digital journey and retain the customer on their channel, for the bank this is increasingly a prominent channel for new customer acquisition and upsell.

This is an area of strong API-led growth for banks.

Historically this growth has been reactive, non-strategic and mainly initiated by large fintechs approaching banks for partnerships. However, according to Levvel’s 2022 BaaS Report, while less than 10% of banks globally have implemented BaaS offerings, ~88% are considering or actively pursuing BaaS partnerships strategically in the near future. The go-forward view among Indian banks is similar - most of the leading private banks have already made significant investments towards partnership APIs.

Direct and indirect selling partners: while BaaS consumers are those that offer banking services to their customers to complete their journeys, this archetype is a narrow bucket of partners who help banks specifically with direct or indirect sales of bank products and services. This includes direct selling agents, business correspondents, aggregators, and also co-branding partnerships on banking products.

Similar to BaaS partnerships, working with sale partners is becoming strategically important. For some of the leading Indian private banks, partner channel sales are already contributing to 2-5% of incremental sales across the product range. And for this same reason, these partnerships are not solely under the ambit of banks’ CIOs / CDOs, but have become a strategic focus for business and product.

Technology service providers: banks continuously work with a large number of third party providers for technology services, software and tools. Additionally, especially large banks have a large dedicated IT department for developing and maintaining digital offerings.

For such a working arrangement to scale while maintaining security, data privacy and protection, and contain costs and timelines, internal APIs are key. According to this research from McKinsey & Company, as of 2022, ~77% of the APIs developed are internal - for use internally within the enterprise and by TSPs developing for the enterprise, and focus on internal APIs is expected to sustain.

Other internal software: as do all enterprises, banks have a large number of systems and software licensed or developed by different vendors, that needs to communicate with each other.

For example, the contact center solution and the bank’s AI chatbot needs to be connected to the core banking systems, the credit card systems, and the CRM so that when a customer calls, the agent or relationship manager is able to identify them, and appropriately resolve their issue. This interconnectedness is also delivered via APIs.

Government and other offerings: banks also offer APIs for several related services including KYC (Aadhaar-based eKYC and video KYC), PAN verification, etc., and also API-based services for specific regulatory and government use cases such as challan payments, GST payments, etc.

Which of these actually make money for the bank?

Banks make money from their banking products and services, but not from sale of technology - this includes APIs.

Currently, open banking APIs themselves are largely not a saleable offering, in the same way as internet banking or mobile banking is not a saleable offering.

Depending on the nature of partnership and partner, the bank and the partner may enter into various types of agreements on customer, revenue, costs and operations sharing - these are generally custom and specific to each partnership.

However, there is a compelling business case offered by each of the partnership type - whether is it new customer acquisition, product upsell and cross sell, or even customer retention, which justifies the investment in API-based offerings.

How are these partnerships functioning currently?

The short answer is, they’re held together by duct tape.

While regulation has acted as a catalyst, open banking (in India and globally) has grown as stitching together of IT-led point solutions, and not as a business strategy. This is further exacerbated by heavy reliance on complex legacy systems.

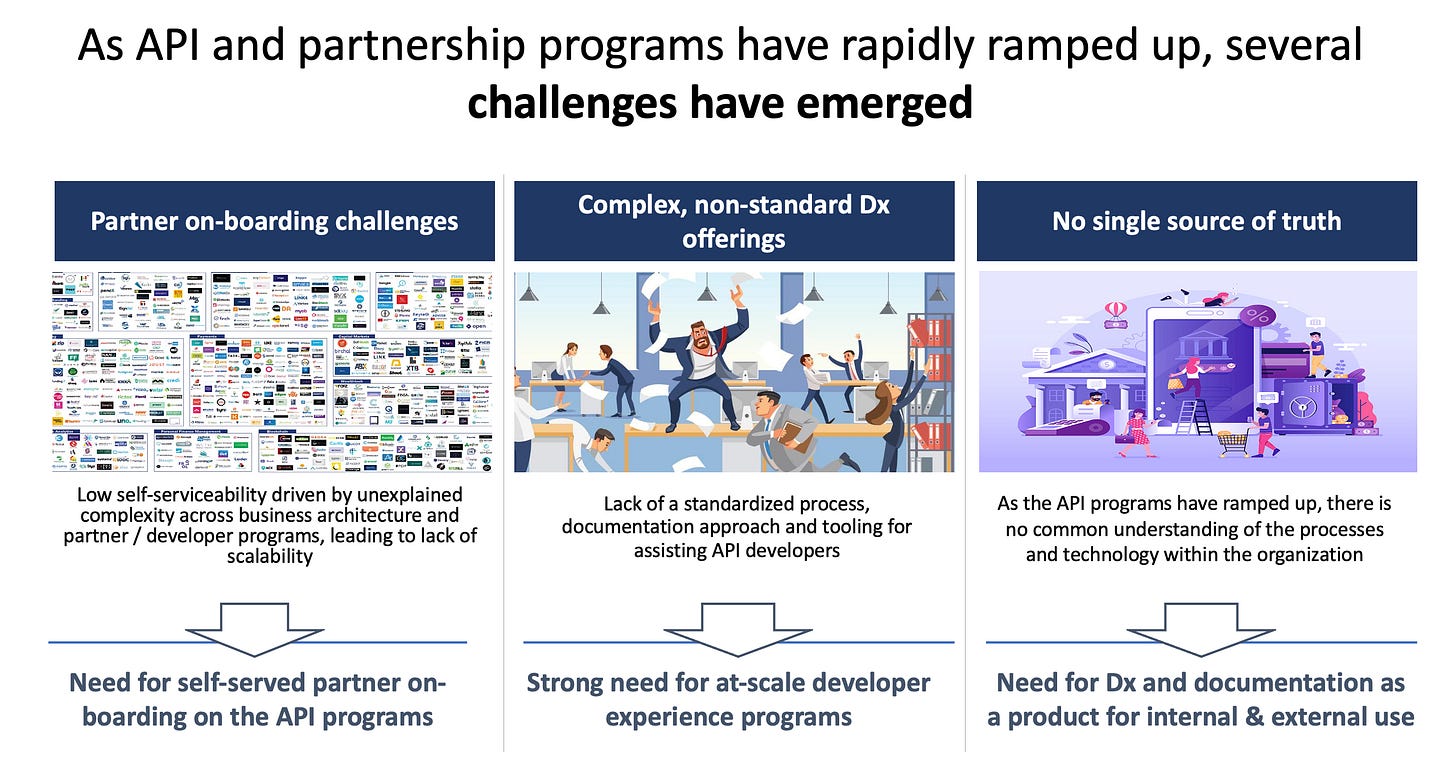

This has led to several challenges -

Partner on-boarding challenges - partners have to go through a tedious non-digital on-boarding process, liaise with multiple teams, navigate complex tech systems even before they can start innovating on their offerings.

Complex, non-standard DX offerings - there’s very little emphasis on the developer. Documentation is minimal, and we are yet to come across well-maintained and functioning developer tools to assist the development.

No single source of truth - leading to high operational effort and costs for the bank across partner on-boarding, solution development, and customer issue resolution.

This culminates in a somewhat broken experience for the end-customer as well. The journey is seldom end-to-end digital and requires immense backend operational support.

What do partners want?

More APIs - there are several gaps in the current portfolio of API offerings of most leading banks. The customer journey either cuts over directly to the bank and away from the partner’s portal, or is completed in a broken, non-digital manner.

Shorter integration timelines - the current process of integration takes anywhere from 2-8 months on average. For partnerships to scale and for the partnership proposition to be attractive, this has to shrink down to ~2 weeks.

Lower integration development effort - the integration effort for both sides currently is high - the banks are typically deeply involved in solutioning and even customizing their offerings for large partners, and because of the lack of developer tools, the effort is further multiplied in the form of support.

This also renders partnerships feasible only for larger companies with sizeable development teams, and makes the playing field unequal.

So, what’s the next big thing?

The opportunities promised by “Open Banking” are numerous, but the ecosystem participants have barely scratched the surface.

But a mindset shift has taken place - bank leadership no longer thinks of APIs as tech tools, but as a gateway to newer, innovative business models, new customer segments and new product markets - this has broken down the institutional silos and brought the digital and business teams together towards a more strategic and programmatic approach towards API-led partnerships.

While traditional financial institutions had initially perceived fintechs and challenger digital banks as threats, this has now given way to a mindset of win-win partnerships.

APIs as a strategy

A focused, programmatic approach towards API-led banking offerings require that banks approach these offerings and partnership as a significant lever of future growth.

Banks are now beginning to include these as part of their business plans, and dedicate the required level of resources, investments and effort towards meeting these development goals.

Partner as a customer

Treating a partner as a customer entails designing a partner experience with as much emphasis as customer experience - instituting a strong customer-centric attitude at all partner touch points and adopting the right technology to smoothen the friction points.

From a sales and business development perspective, this requires developing the new teams and skills required to drive growth in, and nurture partnerships with companies that traditionally banks have rarely worked with.

Developer as a customer

Developers are no longer executors, but active decision-makers in the partnerships process, and banks have no choice but to solve for their distinctive experience.

This not only includes the right set of developer tools, documentation and processes, but an overall developer-first approach. For further reading on this topic, see “What is Developer Experience in API Banking”.

API platform

While banks have started out with few APIs focused on specific use cases, thinking of the API technology as a platform forces the enterprise to take a comprehensive and long term approach to offerings design. This includes

Frameworks for internal, partner and public UIs

Distinctive API design - building durable orchestration and connectors

Governance - including API design standards, UI and UX guidelines

Security, data protection and privacy

This also includes taking a long term view to use cases, and how they are likely to evolve - in order to develop technology that scales and ages well.

At apibanking.com, we help you deliver a distinctive partner and developer experience. To learn more, visit www.apibanking.com or write to us at info@apibanking.com

Photo by Katerina Pavlyuchkova on Unsplash.